I.IV. The Toolbox is Filled – We Just Need to Apply It at Scale

Commoditisation trends in both software and foundational hardware technologies, have lowered the entry barrier to build powerful, yet cost-effective physical end-products, thereby creating a step-change in attractiveness of many Vertical Integrator business cases. Combined with a renewed urgency in industrial and governmental buyers, an adoption flywheel accelerated over the past 24 months, unlocking all the ingredients to rapidly build powerful, scalable, vertically integrated, Techno-Industrial champions.

In this chapter:Hardware Technology DriversSoftware Technology DriversThe Flywheel that Makes It All Possible

We previously touched on one of the key characteristics of Vertical Integrators being the combination and integration of cutting-edge, but largely proven hardware technology, robotics, and AI software to drive a meaningful step change in efficiency and scalability in a complex, physical value chain.

Riding these exogenous technology curves is a key driver to outcompete incumbents and maintain relevance or even dominance for decades, rather than becoming the sluggish incumbent themselves.

The improvements in foundational hardware technologies and the commoditisation of SaaS/AI create the perfect storm for a new wave of cost-effective, yet powerful physical end-products.

Hardware Technology Drivers

Over the past decade, a set of once-specialised hardware technologies has become cheap, modular and globally standardised, reshaping the economics of building physical products. What used to require large engineering teams and bespoke supply chains can now be assembled by small, lean startups, thanks to cost curves that continue to fall and performance that keeps compounding.

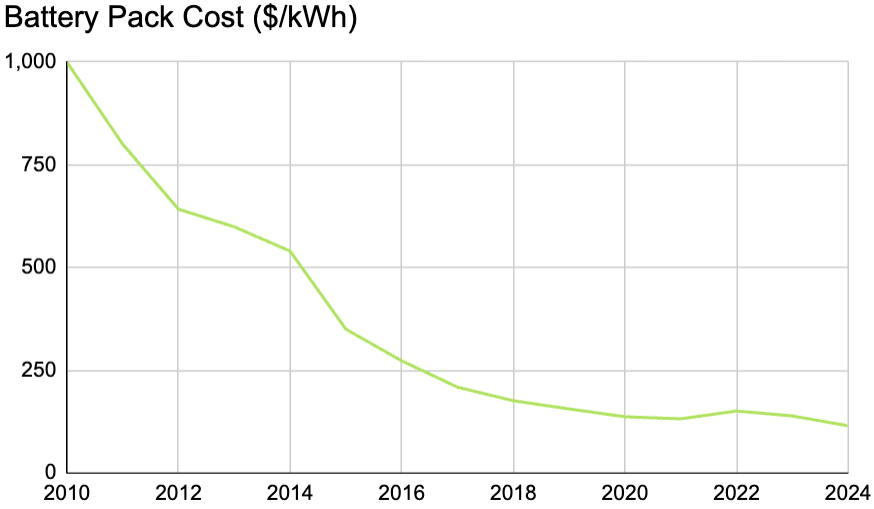

Battery technology is the clearest case: Pack prices for lithium-ion have fallen nearly 90% since 2010, averaging ca. $115/kWh in 2024, with LFP cells in China reported at $50-60/kWh. New chemistries, such as LMFP cathodes and sodium-ion designs, are reaching unparalleled energy density of 180 Wh/kg at cell level, while early solid-state or lithium-metal prototypes exceed 350 Wh/kg at the cell level. Over the next few years, mainstream batteries are expected to gain another 10-20% in energy density, with premium solid-state formats achieving 25-30% or more in niche applications. For mobile robots, drones, and wearables, that translates directly into lighter systems or longer endurance without redesigning the rest of the platform.

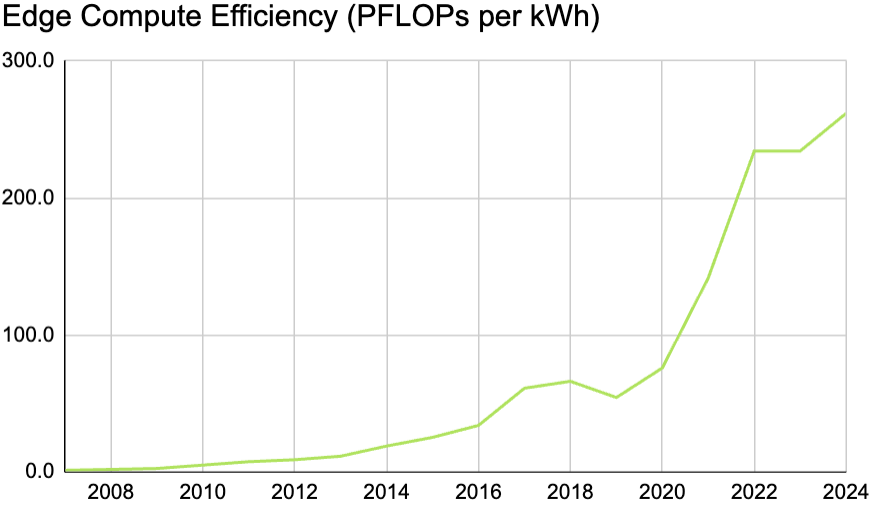

Edge compute has undergone a similar transformation: Edge-AI modules such as NVIDIA’s Orin Nano already offer 60-100 TOPS of inference for under $500, and emerging low-power application-specific integrated circuits (ASICs) are bringing high-performance vision and planning to devices running on single-digit watts. This allows real-time autonomy without an always-on cloud link, reducing latency, bandwidth costs, power requirements and privacy risk, while increasing reliability and unlocking new use cases.

Sensing has seen not just falling prices but leaps in quality, size, and robustness. Automotive lidar has dropped from $75k prototypes to $300-500 production modules, headed below $200 for ADAS. mmWave radar chips cost about $10-15 in volume, and 6-9-axis IMUs are only a few dollars. Beyond cost, sensors are smaller, better sealed, and more tolerant of shock, vibration, and weather - key for reliable operation in harsh and unpredictable environments. That enables rugged and powerful multi-sensor suites across vision, inertial, and environmental, on assets as diverse as drones, farm equipment, and industrial robots, without forcing compromises in weight or reliability.

Connectivity is now largely plug-and-play: NB-IoT and LoRa modules cost just a few dollars, and LTE-M, BLE, and Wi-Fi come with integrated stacks and secure over-the-air updates. Prototyping and manufacturing tools/providers are a key enabler - two-layer PCBs from major fabs cost only a few dollars with 24-hour turnaround, while desktop CNC and additive tools let startups iterate in hardware almost as quickly as in software.

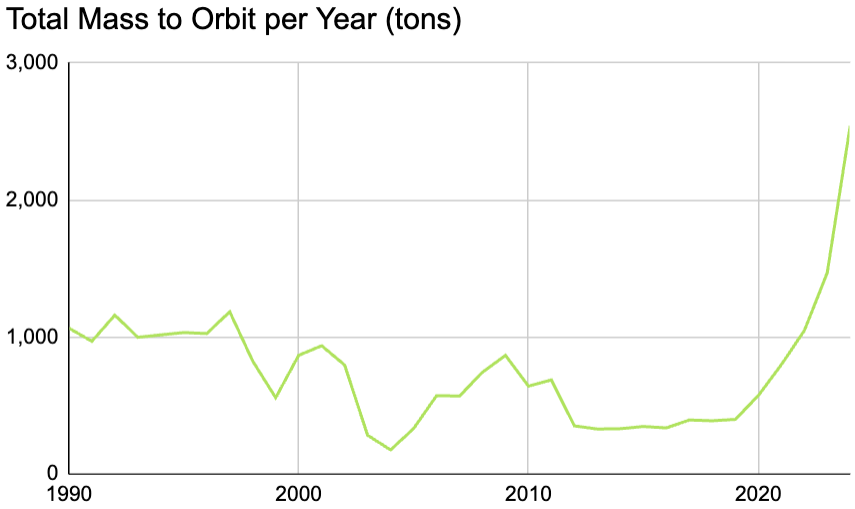

Even access to orbit has normalised, with Falcon-class rockets cutting launch costs to ≈$2k/kg, opening constellations and space-to-ground services to small companies - a further step-change is expected once SpaceX’s Starship becomes operational and other micro-launchers start to scale. Starlink and other low-earth-orbit (LEO) constellations have added a global, high-bandwidth layer. Hardware teams can deploy connected assets in remote environments, oceans, or disaster zones without building bespoke telecom infrastructure, while also streaming data for testing and updates anywhere on the planet.

Lastly, the “middle layer” that binds disparate hardware components into coherent systems has been modernised. Standardised middleware - ranging from ROS 2 in robotics to lightweight real-time operating systems, modular device drivers, and protocol-translation frameworks - is making batteries, sensors, compute boards, and communications modules far more interoperable, by abstracting away their quirks while bundling safety, certification, and security primitives. Modern stacks now ship with plug-and-play APIs, auto-discovery of peripherals, and cloud-native management services, reducing the custom firmware once needed to make components talk to each other.

This maturation of the integration layer means teams can focus on architecture and product logic instead of low-level plumbing, accelerating time-to-market and allowing small startups to assemble sophisticated hardware-software stacks with a fraction of the historical engineering overhead.

Together, these curves push the centre of gravity in terms of value capture away from component invention toward integration, software, certification, and operations. Winning startups assemble cheap energy storage, efficient compute, high-fidelity sensors, ubiquitous connectivity, and rapid fabrication into reliable, certifiable systems. Then ride exogenous technology curves for compounding gains. A drone designed today might fly 15-20% farther in three years simply by adopting a new pack chemistry, ceteris paribus, while better sensors and lighter compute boards will expand its capability envelope without redesigning the airframe.

For vertical integrators, this dynamic compounds: tighter feedback loops enables rapid iteration between technology, manufacturing, and field data to help them improve capability and scale unique data assets to out-execute incumbents on both time-to-market and unit economics.

Software Technology Drivers

Software and AI have entered an increasing phase of commoditisation in a way that fundamentally reshapes how physical products, and Vertical Integrators in particular, are built: A small team of talented developers can now rapidly pull a unified data layer and a concatenation of AI products over a complex physical value chain.

A key enabler is the surge in developer productivity from LLM tools: across multiple studies, AI coding assistants have boosted developer productivity by 20-50%, cutting time-to-first solution and error rates, with early-stage teams often reporting even higher gains because greenfield codebases and fast iteration maximise the benefit. GitHub’s research on Copilot shows a 55% reduction in coding time for common tasks.

Beyond coding, simulation and design platforms have been transformed by embedded AI. Parametric CAD and physics solvers now incorporate foundation models that understand geometry, materials, and loads, allowing engineers to explore high-dimensional trade-offs for more cheaply and quickly. Generative design unlocks completely novel geometry optimised for manufacturability, strength, and cost, all running on modest cloud instances. These tools ingest vast domain complexity (materials, tolerances, supply incentives), enabling smaller teams to explore more design space and risk far more cheaply and on breakneck iteration cycles.

Another inflection is the rise of unified data pipelines. Whereas five years ago design, testing, field performance, feedback loops, and supply chain were mostly siloed, modern platforms enable centralized ingestion, versioning, labeled data, and cross-domain analytics. This means a team can build predictive diagnostics, digital twins, quality inspection, logistics optimisation and feedback into product roadmaps from the start. Edge AI & cloud offerings now make deploying inference, monitoring, and feedback loops simpler and cheaper.

The modern tool stack provides small teams in hardware-enabled businesses with the superpowers to build novel, superior products and slash time-to-market cycles.

It’s no longer just about inventing novel components but about how companies orchestrate mature software modules, domain-data, and feedback to deliver product performance, reliability, and speed. Those who leverage LLM-assisted coding, AI-augmented simulation, and unified data will iterate faster, catch design flaws earlier, push more thoughtful physical prototypes, and ultimately deliver better unit economics and time-to-market. This level of integration and speed was simply not possible at scale just three to five years ago.

The Flywheel that Makes It All Possible

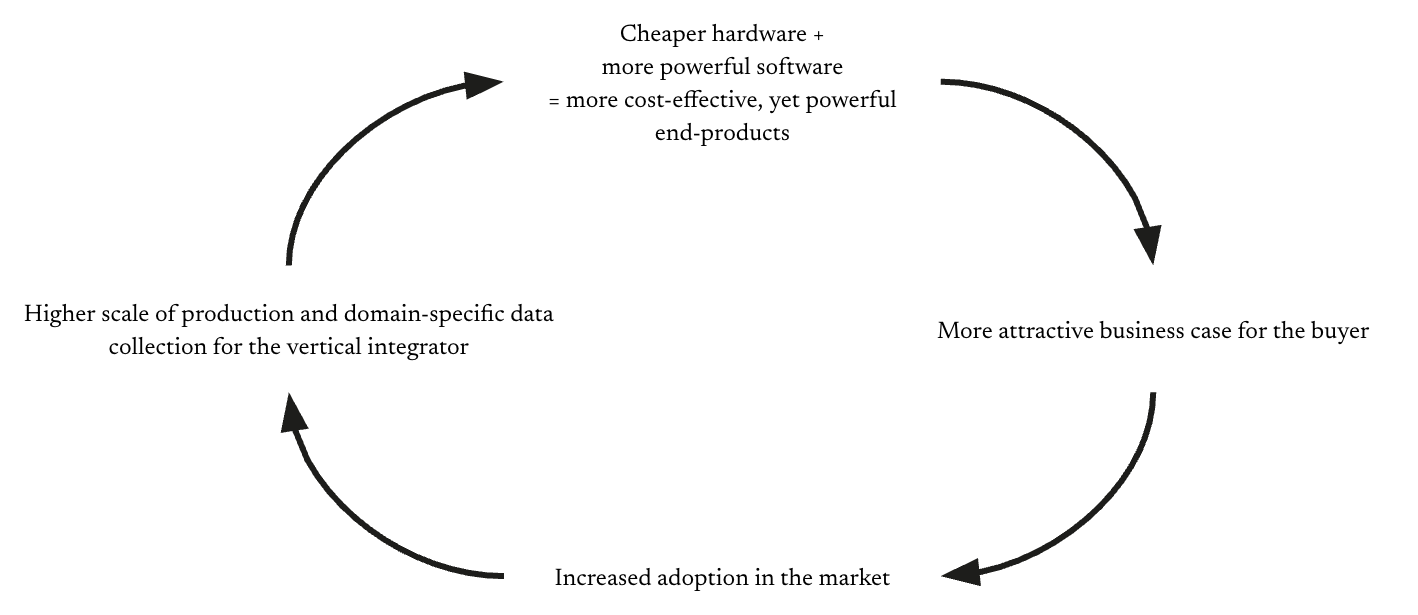

The commoditisation and standardisation of foundational hardware technologies in combination with higher leverage on advanced software, enables tech startups to build more cost-effective, yet powerful end-products at attractive margins.

More powerful products at lower unit cost unlocks more attractive business cases and drastically shorter payback times for buyers: 50% higher value creation at half the cost compared to previous solutions, could turn a 2-year payback period for a commercial buyer into 8 months - suddenly making the purchase decision a no-brainer and subsequently driving mass-adoption in the market.

As adoption accelerates, a virtuous cycle emerges: greater scale drives bulk procurement discounts, leaner manufacturing, and lower per-unit costs. Simultaneously, increased deployment leads to orders of magnitude more data from real operations - sensor logs, usage and failure modes, environment / context variation - to train smarter, proprietary models and educate the product roadmap.

This results in even cheaper and even more powerful end-products, making the business case even more attractive, driving further adoption, reducing cost, more data, better products and so on…

At the same time, pressure on industrial buyers is increasing, driven by the need to reshore their production, supply chain disruptions, skilled worker shortages, geopolitical risk and cost fluctuations.

All of the above unlocks an incredibly powerful flywheel of game-changing products and ultimately true mass-adoption of real-world AI technologies. It also leads to faster time to market, non-linear scaling, much lower capital requirement and higher defensibility, thereby significantly increasing the share of Vertical Integrators to be considered “venture-grade”, or suitable for VC-backing. This is what underpins the Cambrian explosion we’re starting to see today.

Source: Own Illustration

The West already has the tools to save itself - technologies that make manufacturing faster, energy cleaner, defence smarter, and infrastructure cheaper. What’s missing is integration, rather than scientific invention: aligning software, robotics, AI, and new hardware into coherent systems that are designed to scale. Just as past industrial revolutions were driven by steam, steel, and electricity, today’s transformation is built on AI automation, data, and computation. The challenge is to apply these tools to the physical economy with urgency and focus, not as scattered point solutions but as building blocks of enduring platforms.

The integration flywheel has the potential to return security and prosperity to the Western world, while creating trillions in enterprise value over the next decade.

Next chapter: Talent migration and Vertical Integrators’ unique opportunity for powerful storytelling.

Next Chapter:

I.V. Talent & The Power of Storytelling